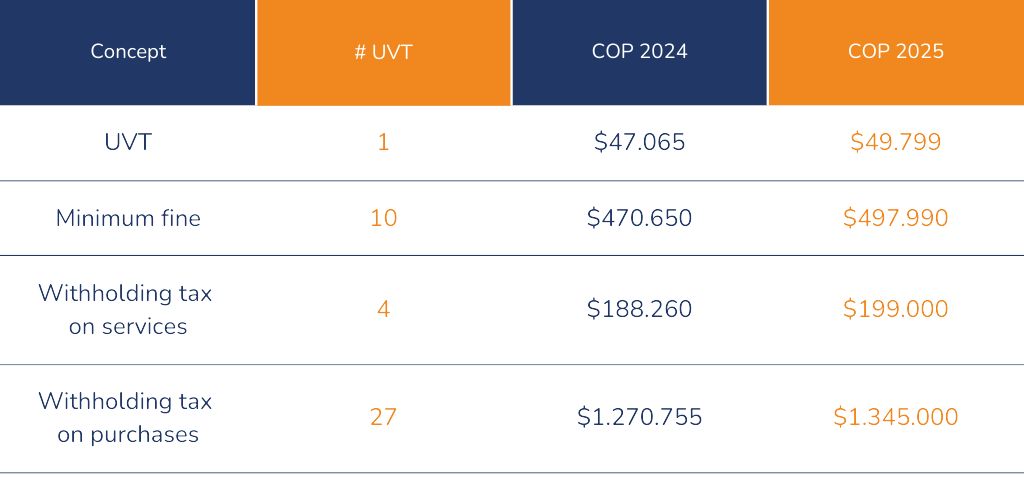

In the Colombian tax system, the Tax Value Unit (UVT) plays a key role in determining taxes, penalties, and other fiscal obligations. For 2025, the UVT has been set at $49,799 COP, representing an increase of $2,734 COP compared to the 2024 value, which was $47,065 COP. This adjustment will have a direct impact on fiscal and budgetary operations, especially for foreign companies operating in Colombia.

What is the UVT and why is it important?

UVT is a unit of measure adopted in the Colombian tax system to simplify the calculation of taxes, penalties, and other tributes. Instead of setting fixed amounts, Colombian regulations establish values in UVT, adjusted annually based on inflation.

Its relevance lies in the fact that it affects multiple aspects of business taxation, such as:

- Tax declaration thresholds

- Calculation of tax penalties

- Minimum amounts for withholding taxes.

Therefore, any change in the UVT directly impacts the fiscal projections and tax obligations of companies.

Impact of the new UVT value on foreign companies

Foreign companies operating in Colombia must adjust their tax processes annually according to the new UVT value. The increase for 2025 will have significant effects in various areas:

-

Tax declaration:

The increase in the UVT raises the tax thresholds that determine whether a company must file taxes. This modifies the minimum levels of income and assets that require companies to submit their tax returns. -

Determinación de sanciones:

Tax penalties are calculated based on the UVT, which increases their final value. For example:

-

- A penalty of 10 UVT in 2024 was equivalent to $470,650 COP.

- In 2025, that same penalty will be $497,990 COP.

-

Withholding taxes: The minimum amounts for withholding taxes are also adjusted with the UVT value. For 2025, the applicable values will be:

-

- $199,000 (4 UVT): Minimum amount for withholding tax on services.

- $1,345,000 (27 UVT): Minimum amount for withholding tax on purchases.

-

Labor and corporate obligations:

Legal obligations, such as parafiscal contributions and other financial commitments, must be adjusted to the new value, which will impact budgets and financial projections.

Practical example of the impact of the UVT

To understand how the variation in the UVT affects, let's consider the following case.:

- In 2024, a penalty for late submission of 20 UVT was equivalent to $941,300 COP.

- In 2025, with the new UVT value, that same penalty will be $995,980 COP, representing an increase of $54,680 COP.

Este tipo de incrementos debe tomarse en cuenta al elaborar presupuestos anuales y planear las estrategias fiscales de la empresa.

Recommendations for foreign companies

To mitigate the impact of the UVT increase, foreign companies should implement the following actions:

-

Adjust fiscal budgets

Update financial projections to include the higher tax costs resulting from the new UVT value. -

Review and update accounting processes

Ensure that accounting and tax systems reflect the new value, avoiding errors in tax calculations, withholdings, and penalties. -

Consult with tax experts

Rely on the advice of tax professionals who correctly interpret the regulations and optimize tax obligations.

Globalgaap helps you

At Globalgaap, we understand the challenges foreign companies face when adapting to the Colombian tax system. Our team of experts offers

- Tax advisory

- Fiscal consulting

- Regulatory compliance

Since 2012, we have been strategic partners of foreign companies in Colombia, combining a global perspective with extensive experience.

Conclusions

The adjustment of the UVT for 2025 may seem like a minor change, but it has significant implications for the calculation of taxes, penalties, and other tax obligations. Anticipating these changes is the best strategy to ensure regulatory compliance and avoid costly penalties.

If you have any questions about how the new UVT value may affect your company's fiscal operations, contact us! At Globalgaap,

we are ready to help you navigate the Colombian tax system efficiently and accurately.

Leave Your Comment Here